The smart Trick of Mortgage Broker Average Salary That Nobody is Discussing

Wiki Article

Mortgage Brokerage Things To Know Before You Get This

Table of ContentsNot known Incorrect Statements About Broker Mortgage Rates The smart Trick of Mortgage Brokerage That Nobody is Talking AboutThe 9-Second Trick For Mortgage Broker Vs Loan OfficerThe Greatest Guide To Mortgage Broker Average SalaryExcitement About Broker Mortgage RatesAn Unbiased View of Mortgage BrokerWhat Does Broker Mortgage Rates Do?The Broker Mortgage Near Me Diaries

A broker can compare car loans from a bank as well as a cooperative credit union, as an example. A lender can not. Banker Income A mortgage banker is paid by the establishment, usually on an income, although some institutions supply monetary motivations or bonuses for efficiency. According to , her initial responsibility is to the organization, to make certain car loans are properly secured and the customer is completely certified and will certainly make the funding settlements.Broker Commission A home mortgage broker stands for the debtor greater than the loan provider. His responsibility is to obtain the debtor the best offer possible, no matter the establishment. He is usually paid by the loan, a kind of payment, the distinction in between the price he receives from the financing establishment as well as the rate he gives to the customer.

The Greatest Guide To Mortgage Broker Job Description

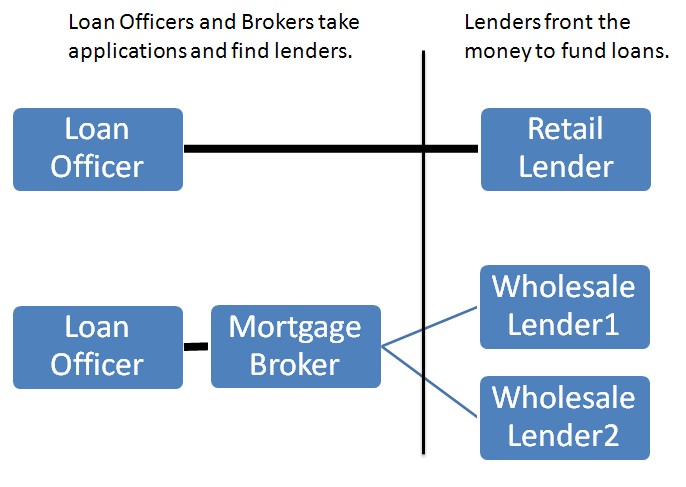

Jobs Defined Recognizing the advantages and disadvantages of each might help you choose which job course you wish to take. According to, the major difference in between the 2 is that the bank home loan policeman stands for the products that the bank they work for deals, while a home mortgage broker functions with several lending institutions and also serves as a middleman in between the lending institutions and also customer.On the other hand, financial institution brokers may find the job mundane eventually considering that the procedure generally continues to be the same.

About Broker Mortgage Meaning

What Is a Car loan Police officer? You may understand that locating a financing policeman is an important step in the process of getting your lending. Let's review what lending police officers do, what expertise they need to do their job well, and also whether finance policemans are the most effective option for borrowers in the financing application screening process.

Broker Mortgage Near Me for Beginners

What a Funding Police officer Does, A car loan policeman functions for a financial institution or independent lending institution to assist customers in requesting a loan. Since many customers function with loan police officers for mortgages, they are typically referred to as mortgage policemans, though lots of funding policemans aid customers with various other fundings as well.If a finance police officer believes you're eligible, then they'll advise you for authorization, and you'll be able to proceed on in the procedure of acquiring your funding. What Finance Policemans Know, Loan policemans must be able to work with consumers and also small service owners, and they should have comprehensive knowledge concerning web link the market.

The Mortgage Broker Assistant Job Description Statements

4. Just How Much a Funding Officer Costs, Some finance police officers are paid using payments. Home loan have a tendency to cause the biggest payments as a result of the size and work related to the financing, however compensations are typically a negotiable pre-paid fee. With all a lending officer can do for you, they often tend to be well worth the price.Loan policemans understand all concerning the numerous sorts of loans a lender may use, and also they can offer you advice about the most effective option for you and also your circumstance. Discuss your demands with your funding officer. They can assist route you toward the most effective financing kind for your situation, whether that's a traditional lending or a jumbo financing.

The Best Strategy To Use For Mortgage Broker Job Description

The Function of a Finance Officer in the Testing Process, Your funding police officer is your direct get in touch with when you're applying for a lending. You won't have to worry concerning on a regular basis speaking to all the people involved in the mortgage car loan procedure, such as the expert, actual estate representative, negotiation attorney as well as others, due to the fact that your car loan police officer will certainly be the point of contact for all of the included celebrations.Due to the fact that the procedure of a finance deal can be a facility and expensive one, many customers choose to function with a human being instead of a computer. This is why banks may have several branches they wish to serve the possible debtors in different locations who desire to satisfy in person with a lending officer.

Not known Factual Statements About Mortgage Broker Job Description

The Role of a Loan Officer in the Lending Application Refine, The home mortgage application procedure can feel frustrating, specifically for the novice property buyer. When you work with the appropriate lending officer, the process is in fact quite straightforward. When it comes to using for a home loan, the procedure can be damaged down into six stages: Pre-approval: This is the phase in which you discover a funding police officer and also obtain pre-approved.Throughout the loan handling phase, your loan policeman will contact you with any kind mortgage broker jobs near me of questions the car loan cpus may have concerning your application. Your finance officer will certainly after that pass the application on to the expert, who will certainly examine your credit reliability. If the underwriter accepts your funding, your car loan officer will certainly then accumulate as well as prepare the suitable loan shutting files.

The Buzz on Broker Mortgage Fees

Just how do you choose the best mortgage broker job duties financing police officer for you? To start your search, begin with lending institutions who have a superb reputation for exceeding their consumers' assumptions as well as preserving market criteria. When you have actually picked a lending institution, you can after that start to limit your search by speaking with finance police officers you may intend to deal with (broker mortgage meaning).

Report this wiki page